Finance is an industry that is constantly evolving and adapting to changing times. In order to stay ahead of the competition, it is important to employ effective growth hacking strategies that will take your business to new heights. In this article, we will delve into the top 30 growth hacking strategies for finance.

Understanding Growth Hacking in Finance

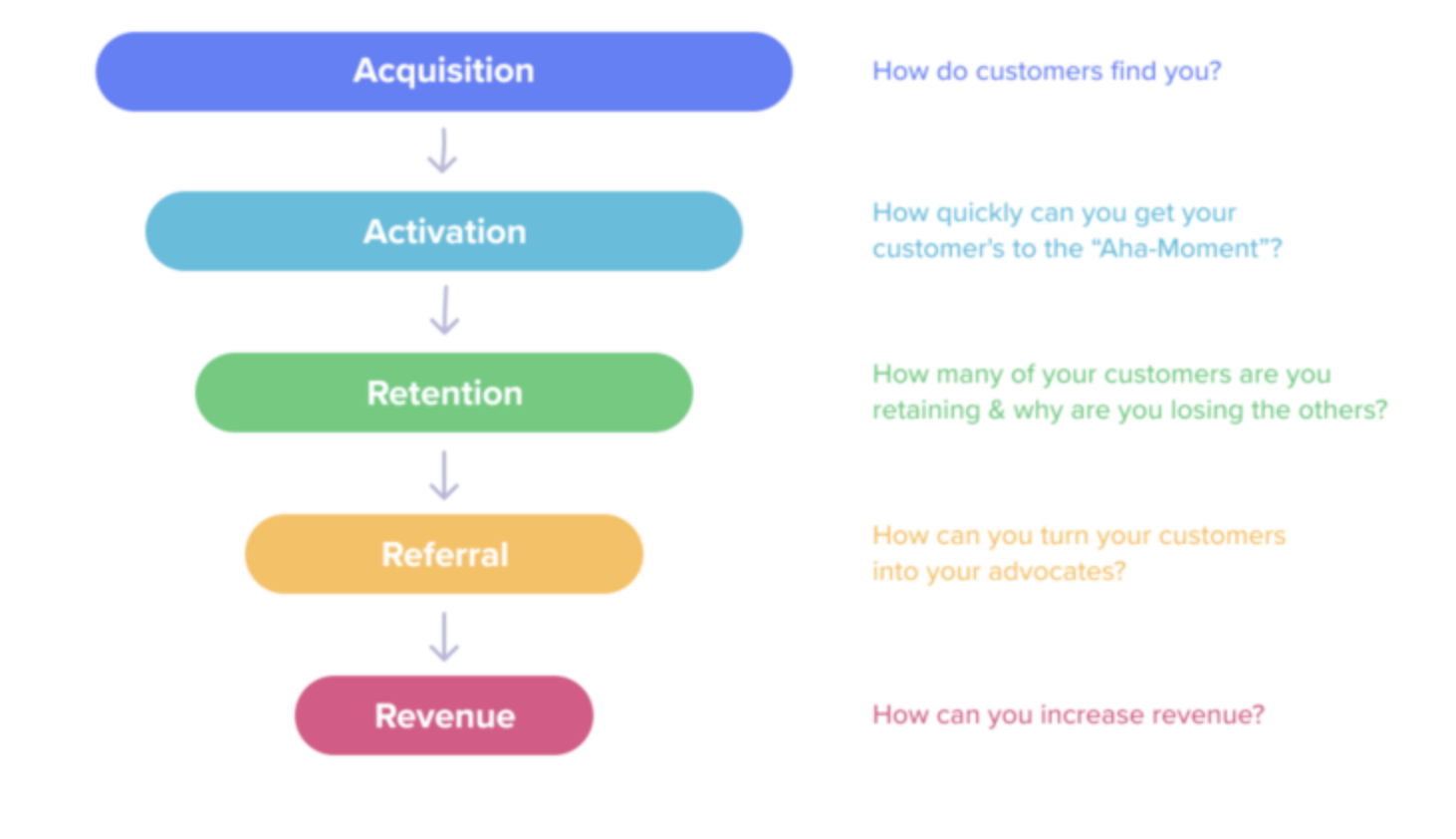

Growth hacking is a data-driven approach to marketing that involves experimenting and constantly testing new strategies to achieve rapid growth. In finance, growth hacking is equally important as in any other industry as the market is highly competitive and the customer behavior is constantly changing. By understanding the basic principles of growth hacking, you can achieve superior results in terms of customer acquisition, retention, and revenue generation.

What is Growth Hacking?

Growth hacking is a process of achieving rapid growth by leveraging unconventional marketing techniques to attract and retain customers. This requires analyzing data, identifying opportunities, and constantly experimenting with new ideas to optimize customer acquisition and retention. One of the key principles of growth hacking is to focus on high-impact, low-cost strategies. This means identifying the most effective channels to reach your target audience and using them to your advantage. For example, instead of investing heavily in traditional advertising, growth hackers might use social media, email marketing, or search engine optimization (SEO) to drive traffic and conversions. Growth hacking also involves a lot of experimentation and testing. This means constantly trying out new ideas and measuring their impact on key metrics such as customer acquisition, engagement, and revenue. By doing this, growth hackers can quickly identify what works and what doesn’t, and adjust their strategies accordingly.

Why Growth Hacking is Important in Finance

Finance is a highly competitive industry, and companies that fail to keep up with the latest trends and techniques will be left behind. Growth hacking is a powerful tool that can help finance companies identify new opportunities, reach new customers, and achieve rapid growth. One of the biggest challenges for finance companies is attracting and retaining customers. With so many options available, customers can be fickle and difficult to please. Growth hacking can help finance companies overcome this challenge by identifying the most effective channels to reach their target audience and using them to their advantage. Another important aspect of growth hacking in finance is data analysis. By analyzing customer behavior and transaction data, finance companies can identify patterns and trends that can be used to optimize their marketing strategies. For example, they might discover that customers are more likely to convert if they receive a personalized offer or if they are targeted with a specific message. Overall, growth hacking is a powerful tool that can help finance companies achieve rapid growth and stay ahead of the competition. By understanding the basic principles of growth hacking and applying them to their marketing strategies, finance companies can attract and retain customers, increase revenue, and achieve their business goals.

Building a Solid Foundation

Building a strong foundation is crucial in any business, and finance is no different. The following strategies can help you identify your target audience, develop a unique value proposition, and establish a strong brand identity.

Identifying Your Target Audience

Knowing who your target audience is, is critical when it comes to growth hacking in finance. By analyzing data and conducting market research, you can gain valuable insights into your customers’ behavior, preferences, and needs. This will allow you to tailor your marketing strategies to meet their specific needs and preferences. For example, if you are targeting millennials, you may want to focus on social media marketing and mobile apps. Millennials are known for being tech-savvy and are more likely to engage with brands that have a strong social media presence. On the other hand, if you are targeting baby boomers, you may want to focus on more traditional marketing channels, such as print ads and direct mail.

Developing a Unique Value Proposition

Once you have identified your target audience, the next step is to develop a unique value proposition that sets you apart from the competition. This could be anything from offering superior customer service to providing innovative financial solutions that are not offered by your competitors. A unique value proposition will make it easier for you to attract and retain customers. For example, if you are a financial advisor, you may want to offer personalized financial planning services that take into account each client’s unique financial situation and goals. This will set you apart from competitors who offer more generic financial planning services.

Establishing a Strong Brand Identity

A strong brand identity is essential in establishing trust and credibility with customers. This can be achieved through consistent branding, messaging, and visuals that clearly communicate your brand values and mission. By establishing a strong brand identity, you can differentiate yourself from competitors and build a loyal customer base. One way to establish a strong brand identity is to develop a brand personality that resonates with your target audience. For example, if you are targeting young professionals, you may want to develop a brand personality that is innovative, forward-thinking, and tech-savvy. This will help you connect with your target audience and build a strong brand identity. Another way to establish a strong brand identity is to be consistent in your messaging and visuals across all marketing channels. This includes your website, social media profiles, and marketing materials. By maintaining consistency, you will build brand recognition and establish trust with your customers. In conclusion, building a solid foundation is crucial in finance, and these strategies can help you identify your target audience, develop a unique value proposition, and establish a strong brand identity. By following these strategies, you can differentiate yourself from competitors and build a loyal customer base.

Data-Driven Decision Making

Data-driven decision making is at the core of growth hacking. By analyzing data and metrics, you can identify opportunities for optimization and continuously improve your strategies. The following strategies can help you leverage analytics and metrics, conduct A/B testing, and utilize customer feedback to achieve optimal results.

Utilizing Analytics and Metrics

Analytics and metrics are essential tools for growth hacking in finance. By monitoring key metrics such as customer acquisition cost, lifetime value, and conversion rates, you can gain valuable insights into your marketing efforts and identify opportunities for improvement.

A/B Testing for Optimal Results

A/B testing involves creating two different versions of content or campaigns and testing them with a small sample of users. By analyzing the results, you can determine which version performs better and optimize your strategies accordingly. A/B testing can help you identify the most effective messaging, visuals, and calls to action, leading to higher conversion rates and customer retention.

Leveraging Customer Feedback

Customer feedback is a powerful tool for identifying opportunities for improvement and optimizing your strategies. By conducting surveys, collecting reviews, and analyzing customer interactions, you can gain valuable insights into your customers’ behavior and preferences.

Digital Marketing Strategies

Digital marketing is an essential component of growth hacking in finance. By utilizing effective SEO, content marketing, social media marketing, and email marketing strategies, you can reach new customers, retain existing ones, and drive revenue growth.

Search Engine Optimization (SEO)

SEO is the process of optimizing your website and content for search engines to improve your visibility and ranking. By conducting keyword research, optimizing your content, and building high-quality backlinks, you can attract organic traffic and increase your conversion rates.

Content Marketing

Content marketing involves creating high-quality, informative content that educates and engages your target audience. This can be achieved through blog posts, social media updates, webinars, and other types of content. By providing valuable content, you can establish trust and credibility with customers, and drive traffic to your website.

Social Media Marketing

Social media marketing involves leveraging social media platforms to promote your brand, engage with customers, and drive traffic and revenue. By creating unique and engaging content, interacting with customers, and utilizing targeted advertising, you can reach new audiences and build a loyal customer base.

Email Marketing

Email marketing involves sending targeted messages to customers and subscribers to promote your brand, products, and services. By segmenting your email list, personalizing your messages, and providing valuable content, you can increase open and click-through rates, and drive revenue growth.

Conclusion

In conclusion, growth hacking is a powerful tool for achieving rapid growth in the highly competitive finance industry. By understanding the basic principles of growth hacking, building a strong foundation, embracing data-driven decision making, and leveraging digital marketing strategies, you can take your finance business to new heights. The above 30 growth hacking strategies are effective, but do not exhaust all possible approaches. All in all, finance companies that adopt growth hacking stand to gain a significant competitive advantage in the industry.